n the world of business, managing debt effectively is crucial for maintaining financial health and ensuring long-term sustainability. Whether you’re a startup or a well-established company, there are times when managing debt can become overwhelming. However, with the right approach to company debt management, businesses can not only keep their operations running smoothly but also pave the way for future growth.

This article will explore what company debt management is, how it works, and the numerous benefits it can offer your business. We will dive into practical strategies, examine real-world applications, and offer tips on how to effectively manage corporate debt.

Key Takeaways

- Strategic Debt Management: A well-structured debt management plan enables businesses to maintain financial stability and avoid overwhelming liabilities.

- Cash Flow Optimization: Effective management of cash flow ensures that businesses have the liquidity needed to meet debt obligations without disrupting operations.

- Improved Creditworthiness: Responsible debt management enhances a company’s credit score, opening the door to better financing options in the future.

- Risk Mitigation: Proactively managing debt helps businesses avoid default and minimize the risk of financial distress or bankruptcy.

- Long-Term Growth: Effective debt management provides businesses with the tools and strategies needed for sustainable growth and profitability.

What is Company Debt Management?

Company debt management refers to the strategic process by which businesses manage their liabilities, ensuring they can meet their financial obligations while maintaining liquidity and operational efficiency. Debt management involves various strategies such as consolidating debt, renegotiating terms with creditors, and optimizing cash flow to make repayments more manageable.

Effective debt management is more than just paying off loans and bills on time; it’s about making informed financial decisions that will benefit the company in both the short and long term. By balancing the need for external funding with the ability to maintain sustainable financial practices, companies can avoid default and safeguard their creditworthiness.

Key Elements of Company Debt Management:

- Debt Consolidation: Combining multiple debts into a single loan with more favorable terms.

- Debt Restructuring: Negotiating with creditors to adjust the terms of debt repayment.

- Cash Flow Optimization: Managing day-to-day operations and finances to ensure that sufficient liquidity is available for debt payments.

- Financial Planning: Setting aside dedicated funds to meet debt obligations and avoid cash shortages.

- Credit Monitoring: Keeping an eye on the company’s credit score and managing relationships with creditors to secure better terms.

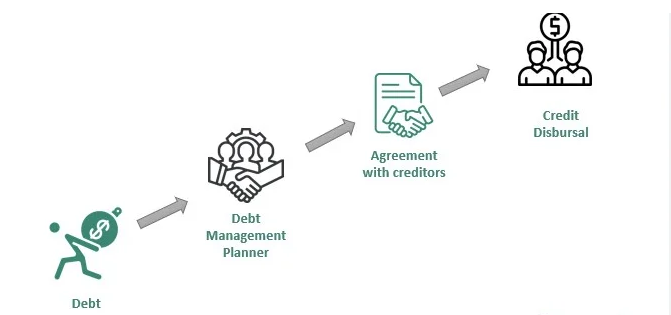

How Does Company Debt Management Work?

Debt management for a company typically follows a step-by-step process, with each step tailored to the unique financial situation of the business. The ultimate goal is to ensure that the business can maintain smooth operations while meeting its financial obligations.

Step 1: Assessing the Current Financial Situation

The first step in any debt management strategy is to thoroughly assess the company’s financial health. This means reviewing all outstanding debts, including short-term liabilities (such as accounts payable) and long-term obligations (like loans or bonds). The company must also evaluate its assets, income, expenses, and cash flow.

This assessment will provide a clear picture of:

- Debt-to-equity ratio: Understanding the ratio between the company’s debt and the shareholders’ equity.

- Liquidity position: Assessing whether the company has enough liquid assets to meet its short-term obligations.

- Interest payments: Analyzing how much of the company’s revenue is going towards servicing debt and interest.

Step 2: Developing a Debt Management Strategy

Based on the assessment, businesses can develop a comprehensive strategy to manage their debt effectively. This strategy may include:

- Refinancing: Refinancing high-interest debt with lower-interest options.

- Debt Consolidation: Combining multiple loans or credit accounts into one loan with better terms.

- Debt Restructuring: Negotiating with creditors for extended payment periods, reduced interest rates, or even partial debt forgiveness.

- Creating a Repayment Plan: Establishing a structured, long-term repayment plan that aligns with the company’s revenue cycle.

Step 3: Implementing Cash Flow Management Practices

Once a debt management plan is established, managing cash flow becomes critical. Cash flow management ensures that the company has sufficient liquidity to meet its debt obligations on time. This includes:

- Monitoring accounts receivable and payable: Ensuring that payments are collected on time and expenses are kept in check.

- Improving working capital: Adjusting the balance between current assets and liabilities to free up cash for debt servicing.

- Budgeting for Debt Payments: Allocating specific funds to service debt payments without compromising day-to-day operations.

Step 4: Monitoring and Adjusting the Plan

Debt management is not a one-time task but a continuous process. Businesses must monitor their debt repayment progress regularly and adjust the strategy if needed. This includes tracking changes in income, expenses, and market conditions that may impact the ability to pay off debt.

A company may also need to:

- Reassess terms: Negotiate better terms if the business’s financial situation improves.

- Refinance when necessary: Refinance existing debt to access better interest rates or repayment terms.

The Benefits of Company Debt Management

Effective company debt management offers numerous advantages, particularly for businesses looking to grow and expand without being held back by excessive liabilities. Here’s how a well-managed debt plan can benefit your business:

1. Improved Cash Flow and Liquidity

By managing debt effectively, businesses can ensure that they don’t drain their cash reserves on high-interest payments. A clear debt management plan enables businesses to allocate cash toward essential operational expenses, such as payroll, inventory, or capital investments. When cash flow is optimized, businesses can ensure smooth operations without constantly worrying about meeting debt obligations.

2. Increased Financial Stability

A strategic debt management plan reduces the risk of default and helps businesses avoid going into financial distress. By consolidating debt or negotiating lower interest rates, companies can stabilize their financial position, making it easier to plan for future growth and expansion. This financial stability can also make the company more attractive to investors, partners, and lenders.

3. Enhanced Creditworthiness

Timely payments and responsible debt management improve a company’s credit score. A stronger credit score translates into better loan terms and access to more favorable financing options in the future. This is crucial for businesses looking to scale up, as better creditworthiness can reduce the cost of borrowing.

4. Greater Control Over Debt Repayment

With a clear debt management strategy in place, companies can have greater control over how they repay their obligations. Instead of scrambling to meet multiple payment deadlines, businesses can consolidate their debt into a single monthly payment, reducing administrative overhead and allowing for better planning.

5. Mitigation of Debt Risks

Debt can come with significant risks if not managed properly. A company that overburdens itself with debt may find it difficult to secure new financing, may be subject to legal actions from creditors, or may face bankruptcy. By managing debt proactively, businesses can minimize these risks and ensure that they remain financially viable.

Further Exploration of Debt Management Strategies

While we’ve discussed the basics of debt management, let’s now dive deeper into the more advanced strategies that businesses can employ to not just manage their debt, but also optimize it in a way that supports their growth objectives. These strategies can include debt restructuring, refinancing, leveraging alternative financing options, and even exploring debt buybacks.

Debt Restructuring: A Powerful Tool for Companies in Distress

Debt restructuring is a strategy that involves renegotiating the terms of an existing loan or debt with creditors in order to make repayment more manageable. Companies in financial distress often use this method to reduce the immediate burden of their debts, while still maintaining a relationship with their creditors.

Debt restructuring can include:

- Extending Payment Terms: Negotiating longer repayment periods for loans or debts, reducing the size of each payment.

- Interest Rate Reduction: Reducing the interest rates on outstanding debts, which lowers the total cost of the debt over time.

- Principal Reduction: In some cases, creditors may agree to reduce the total amount owed, especially if it means the company will be able to repay at least part of the debt.

- Debt Forgiveness: A more extreme option where a creditor agrees to forgive part or all of the outstanding debt, typically in exchange for other concessions, such as a change in the company’s operational structure.

While debt restructuring is a viable solution for businesses facing financial challenges, it is important to note that this can be a time-consuming and often complicated process. Additionally, not all creditors are willing to negotiate, and the company’s reputation may take a hit if it becomes known that it was involved in debt restructuring.

Refinancing: Unlocking Better Terms and Opportunities

Refinancing allows businesses to replace existing debt with new debt under better terms. Refinancing can be a great tool for companies that have improved their financial position since taking on debt or those seeking more favorable interest rates.

Key advantages of refinancing include:

- Lower Interest Rates: A company that’s managed to improve its creditworthiness may be able to refinance at a much lower interest rate, which can save a significant amount of money over time.

- Improved Cash Flow: By extending the repayment period or consolidating multiple loans into one, refinancing can help businesses free up cash flow, which can be used for expansion, operations, or other investments.

- Enhanced Financial Flexibility: Refinancing provides businesses with an opportunity to access additional capital, especially if they can use the equity in their assets or improved financial standing as leverage.

However, refinancing does come with risks, such as the potential for locking into higher fees or new terms that aren’t as favorable as expected. Therefore, businesses must carefully analyze their current financial situation and compare refinancing offers before making a decision.

Leveraging Alternative Financing Options

Sometimes, businesses are faced with the need to take on additional capital but are wary of adding to their existing debt load. In these cases, alternative financing options such as equity financing or asset-based lending can be beneficial.

- Equity Financing: Rather than taking on debt, equity financing involves selling shares of the company to raise capital. While this doesn’t increase debt, it can dilute ownership and control. Companies that are comfortable with sharing ownership may find this a useful way to finance operations or expansion projects.

- Asset-Based Lending: This type of financing involves using a company’s assets, such as real estate or inventory, as collateral to secure a loan. Asset-based lending is typically used by businesses with valuable physical assets but may have difficulty securing loans based on their creditworthiness alone.

Both equity financing and asset-based lending can be excellent alternatives for companies that need funding but are wary of increasing their debt load.

Examples of Successful Debt Management in Action

To better understand how debt management strategies work in practice, let’s explore a few real-world examples of businesses that have successfully employed debt management techniques to overcome financial challenges.

Case Study 1: A Tech Startup Navigates Early Debt Through Refinancing

A tech startup with an innovative software product was initially funded through high-interest loans to get off the ground. As the business grew, its monthly debt payments were cutting into operational budgets, making it harder to invest in marketing, R&D, and customer acquisition.

The company recognized that its high-interest loans were becoming a significant burden and sought out refinancing options. By renegotiating terms and consolidating its debts, the company secured a lower interest rate and an extended repayment period, which freed up cash flow. This additional capital allowed the business to reinvest in its growth, ultimately leading to more customers and an improved bottom line. By refinancing early in its growth phase, the company was able to avoid the risk of default while expanding rapidly.

Case Study 2: Manufacturing Company Utilizes Debt Restructuring

A mid-sized manufacturing company faced increasing financial pressure due to fluctuating raw material prices and stiff competition in the industry. The company was burdened by substantial long-term debt, and creditors were growing impatient with missed payments.

In response, the company entered into debt restructuring negotiations with its creditors. Through extensive talks, it was able to extend its repayment terms and reduce its interest rates. In exchange, the company agreed to streamline its operations and focus on improving its profit margins. The restructuring allowed the company to stabilize its finances, avoid default, and ultimately regain profitability.

This case demonstrates how debt restructuring can provide breathing room for companies dealing with challenging market conditions.

How Debt Management Can Be Integrated Into a Business’s Long-Term Strategy

Effective debt management should not only be seen as a reactive measure, but rather an essential part of a business’s overall strategic planning. Here are a few ways that debt management can be integrated into long-term business strategies:

1. Creating a Sustainable Capital Structure

The optimal capital structure balances debt and equity to ensure that the business can grow while minimizing financial risk. By integrating debt management into strategic planning, companies can ensure they don’t take on excessive debt and risk overleveraging themselves.

A sustainable capital structure:

- Ensures that the business doesn’t rely too heavily on debt to fund operations.

- Allows companies to maintain financial flexibility and weather economic downturns.

- Provides the foundation for seeking more attractive financing options when needed.

2. Budgeting and Forecasting for Debt Payments

A business should integrate debt payments into its regular budgeting and financial forecasting activities. By allocating funds for debt repayment ahead of time and adjusting budgets to accommodate for future debt obligations, companies can ensure that they stay on track and avoid liquidity issues.

3. Planning for Debt in Expansion Strategies

As a company expands, it’s often necessary to take on new debt to fund growth initiatives. However, this should be done strategically, ensuring that the new debt will provide sufficient returns to justify the cost. Companies should evaluate their projected earnings from expansion and ensure that any new debt taken on fits into the long-term financial strategy.

Also Read: What Is A Debt Management Program And How Does It Work?

Conclusion

Company debt management is a vital component of maintaining financial health and ensuring long-term growth. Whether your business is a startup or an established enterprise, effectively managing debt allows you to improve cash flow, reduce financial risks, and position yourself for future success.

By leveraging strategies such as debt consolidation, refinancing, and careful cash flow management, businesses can turn their financial situation around and take full control of their financial future. It’s important to develop a clear debt management plan, continuously monitor progress, and make adjustments as needed.

Implementing the right debt management strategies not only helps businesses avoid default but also enhances creditworthiness, improves cash flow, and reduces the risk of financial distress. Moreover, it ensures that the company is positioned for growth and ready to take on new opportunities without compromising its financial health.

Whether you’re a startup or an established corporation, debt management should be a priority in your business plan. By integrating it with your overall strategy, you can set your company up for sustainable growth and success, even in the face of financial challenges.

Frequently Asked Questions

1. How does company debt management differ from personal debt management?

While both involve managing liabilities, company debt management is typically more complex, involving multiple stakeholders, larger sums of money, and additional factors such as taxation, legal considerations, and credit ratings. Business debt management is tailored to a company’s unique operational needs, while personal debt management focuses on an individual’s finances.

2. Can a company manage its debt without seeking professional help?

Yes, businesses can manage their debt on their own by developing a debt repayment strategy and keeping a close eye on cash flow. However, seeking professional help from financial advisors or credit counseling services can provide expertise and insight, especially for larger businesses with more complex debt structures.

3. Can a company’s debt management plan help improve its credit score?

Yes, by maintaining a consistent repayment schedule, consolidating high-interest debt, and reducing outstanding liabilities, a company can improve its credit score. A higher credit score leads to better loan terms and improved financial opportunities.

4. How can debt consolidation benefit my company?

Debt consolidation allows businesses to combine multiple debts into one loan, simplifying payment schedules, and potentially lowering interest rates. This can ease cash flow management and reduce the stress associated with handling numerous debt payments.

5. What happens if a company defaults on its debt obligations?

Defaulting on debt can lead to serious consequences, including legal action, asset liquidation, loss of creditworthiness, and, in severe cases, bankruptcy. It’s crucial to avoid default by staying on top of debt management and seeking assistance if needed.

6. Can a business refinance its debt under a DMP?

Yes, businesses can explore refinancing options under a Debt Management Plan (DMP) to secure lower interest rates or extended repayment terms. This allows businesses to reduce their financial burden while working towards paying off their debt.

7. Is it possible for a business to renegotiate its debt terms with creditors?

Absolutely. Many businesses can negotiate with creditors to reduce interest rates, extend repayment periods, or even reduce the principal amount owed. This is a common strategy within debt management plans.