Debt is a common financial challenge that many individuals face at some point in their lives. Whether it’s from credit card debt, medical bills, or personal loans, unpaid debt can accumulate quickly and become overwhelming. For those struggling with debt, finding an effective solution is crucial to regain control of their finances and achieve financial stability. A Debt Management Plan (DMP) is one such solution that can help individuals pay off their debts more efficiently and without the burden of high-interest rates.

A Debt Management Plan is a structured program that allows individuals to repay their unsecured debts through monthly payments to a credit counseling agency. This agency negotiates with creditors to reduce interest rates, waive fees, and extend payment terms. The ultimate goal of a DMP is to help individuals become debt-free in a manageable timeframe—usually 3-5 years—by consolidating multiple debts into one affordable monthly payment.

Key Takeaways

A DMP requires a long-term commitment, and you must be willing to stick to the plan in order to achieve debt freedom.

A Debt Management Plan (DMP) helps consolidate multiple unsecured debts into one monthly payment, making it easier to manage and pay off your debt over time.

Credit counseling agencies negotiate with your creditors to reduce interest rates, eliminate fees, and make your monthly payments more affordable.

A DMP can help you avoid bankruptcy and regain control of your finances, providing a structured path to becoming debt-free.

While a DMP may have a temporary negative impact on your credit score, consistent payments will ultimately improve your credit and financial future.

What is a Debt Management Plan?

| Step | Description |

|---|---|

| 1. Assessment | A credit counselor reviews your financial situation, including income, expenses, and debt. |

| 2. Negotiation | The agency negotiates with creditors to lower interest rates, waive fees, or adjust repayment terms. |

| 3. Consolidation | All unsecured debts are consolidated into a single monthly payment to the credit counseling agency. |

| 4. Payment Distribution | The credit counseling agency distributes your monthly payment to creditors according to the agreed-upon terms. |

| 5. Support & Education | Ongoing support from the agency, including regular progress updates, financial education, and guidance to help manage finances. |

| 6. Completion | After 3 to 5 years, the debt is fully repaid, and you are debt-free, with the potential for an improved credit score. |

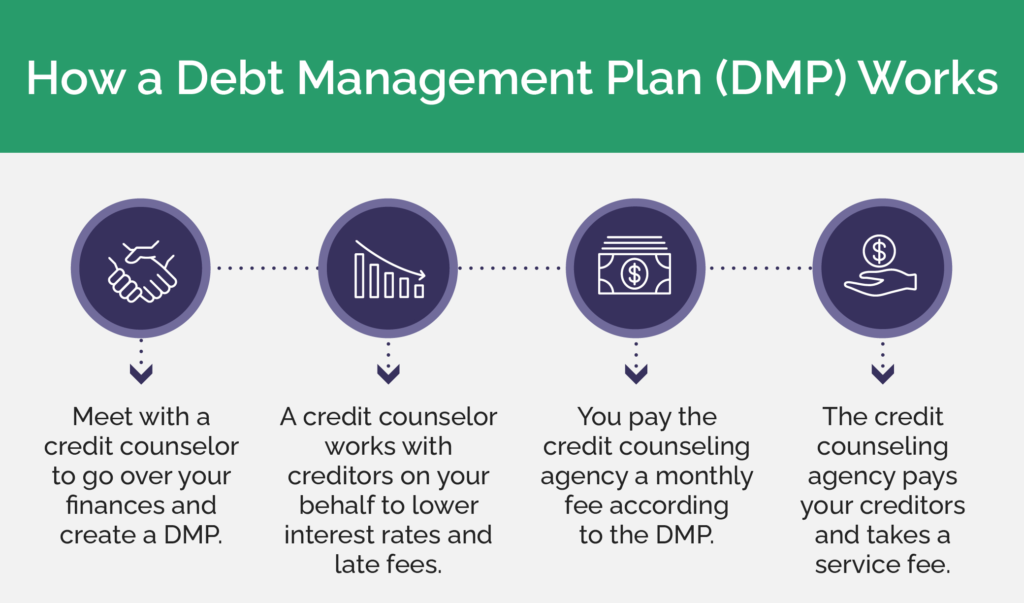

How Does a Debt Management Plan Work?

1. Evaluation of Your Financial Situation

- Consultation with a Credit Counseling Agency:

The first step in a DMP is to meet with a certified credit counselor who will evaluate your overall financial situation. They’ll review your income, expenses, and outstanding debts to determine if a DMP is the right option for you. - Reviewing Your Debts:

The counselor will assess all your unsecured debts, including credit cards, medical bills, and personal loans. The goal is to understand your financial struggles and come up with a feasible repayment strategy. - Creating a Budget:

Your counselor will also help you develop a realistic budget that accounts for your daily living expenses, as well as the amount you can afford to pay toward your debts each month.

2. Negotiating with Creditors

- Contacting Creditors:

Once your financial assessment is complete, the credit counseling agency will contact your creditors on your behalf. The purpose of this communication is to negotiate better terms for your debt repayment, including:- Lower interest rates

- Waiver of late fees and penalties

- Possibly extending the repayment period to reduce monthly payments

- Agreement with Creditors:

The counselor will work to get your creditors to agree to a reduced interest rate or modified terms that make your debt more manageable. Some creditors may agree to stop charging additional fees or even forgive a portion of your debt.

3. Consolidation of Debts

- Single Monthly Payment:

The key feature of a DMP is debt consolidation. After the creditors agree to the terms, you will make one monthly payment to the credit counseling agency, which will then distribute the funds to your creditors according to the agreed-upon terms. - Fixed Payment Plan:

You will pay a fixed monthly amount, which typically includes both principal and interest, to the credit counseling agency. This fixed payment helps you stay on track to become debt-free within a set period, typically 3 to 5 years.

4. Ongoing Monitoring and Support

- Ongoing Management of Your Account:

Throughout the term of the DMP, the credit counseling agency will monitor your account and ensure that all payments are being made on time. They will also handle any communication with creditors, leaving you free from the stress of dealing with them directly. - Access to Financial Education:

Many credit counseling agencies offer ongoing financial education to help you improve your money management skills and avoid future debt issues. This includes budgeting workshops, debt management strategies, and tips on improving credit. - Regular Updates:

The agency will provide regular updates on your progress, including how much debt you’ve paid off and how much is left to repay.

5. Successful Completion of the DMP

- Debt-Free Goal:

The primary goal of a DMP is to help you pay off your unsecured debt within a set time frame, typically 3 to 5 years. Once you’ve made all the required payments and settled your debt, you will have successfully completed the program. - Improved Financial Health:

As you make consistent payments, your financial situation should improve, with a reduction in overall debt, a better credit utilization ratio, and the possibility of an improved credit score over time. - Certificate of Completion:

Upon finishing the DMP, you may receive a certificate of completion, signifying that you’ve paid off your debt. This is a positive step toward financial recovery and a fresh start.

Benefits of a Debt Management Plan

1. Simplified Debt Repayment

- Single Monthly Payment: Consolidates all unsecured debts into one easy payment.

- Automatic Payment Distribution: Credit counseling agency handles payment distribution to creditors.

- Eliminates Multiple Due Dates: No more tracking different due dates for each creditor.

2. Lower Interest Rates

- Negotiated Reduced Interest Rates: Credit counselors work with creditors to lower interest rates, reducing the total debt over time.

- Potentially Lower Monthly Payments: Reduced interest can make monthly payments more affordable.

3. Waived Fees and Penalties

- No Late Fees: Late fees may be waived as part of the negotiation process.

- No New Fees: Creditors typically agree to stop charging additional fees during the DMP.

4. Avoiding Bankruptcy

- Alternative to Bankruptcy: A DMP provides a way to repay your debts without filing for bankruptcy.

- Prevent Long-Term Damage to Credit: Unlike bankruptcy, a DMP helps you maintain a better credit history.

5. Improved Credit Score Over Time

- Timely Payments: Consistent payments can improve your credit score in the long run.

- Lower Credit Utilization: As you pay down balances, your credit utilization ratio decreases, boosting your score.

- Positive Creditor Reporting: Creditors report your progress, which can enhance your credit history.

6. Professional Financial Guidance

- Personalized Debt Assessment: Credit counselors evaluate your financial situation and create a tailored plan.

- Budgeting and Financial Education: Many agencies offer education to help you manage your finances better.

- Ongoing Support: Counselors are available for advice throughout the process.

7. Stress Relief and Peace of Mind

- Reduced Financial Anxiety: The structured nature of a DMP reduces the stress of managing multiple debts.

- Focus on Progress: With a clear plan in place, you can focus on becoming debt-free without constant worry.

Risks of a Debt Management Plan

1. Impact on Your Credit Score

One of the most significant concerns for individuals considering a Debt Management Plan is the potential impact on their credit score. Here’s how a DMP may affect your credit:

- Initial Drop in Credit Score:

When you enter into a Debt Management Plan, it may cause a temporary dip in your credit score. This happens because your creditors may report to the credit bureaus that you’re enrolled in a DMP, which could be seen as a sign that you’re struggling to manage your debt. However, this impact is often short-lived. - Possible Long-Term Effects:

Over time, your credit score can improve if you consistently make on-time payments through the DMP. However, if you miss payments or fail to follow the terms of the plan, it could lead to a further decline in your score. - Closed Accounts on Your Credit Report:

Creditors may agree to close your accounts once you enter into a DMP. This can reduce your available credit, which can have a negative impact on your credit score due to an increased credit utilization ratio.

2. Limited to Unsecured Debts

A Debt Management Plan only applies to unsecured debts, such as credit card balances, medical bills, and personal loans. It does not cover secured debts like:

- Mortgages

- Car loans

- Student loans

If you have significant secured debts, you will still need to manage those separately. This can lead to difficulty if your secured debts also represent a large portion of your financial burden, and you may need to explore other options, such as refinancing or debt consolidation for those loans.

3. Creditors May Not Agree to the Terms

While credit counseling agencies will negotiate on your behalf, not all creditors may be willing to agree to the terms of the Debt Management Plan. Some of the potential challenges include:

- Refusal to Lower Interest Rates or Waive Fees:

Some creditors may not be willing to lower your interest rates or waive fees. If this happens, it may affect the overall effectiveness of the DMP. In some cases, creditors may choose to exclude your account from the program, leaving you with the full burden of that debt. - No Guarantee of Success:

While most creditors are willing to work with credit counseling agencies, there is no guarantee that all creditors will be cooperative. This could lead to delays in your debt repayment or result in your DMP not being as effective as expected.

4. Restrictions on New Credit Use

When you enroll in a Debt Management Plan, you are typically required to agree to the following restrictions:

- No New Credit Cards or Loans:

One of the primary goals of a DMP is to help you get out of debt. To achieve this, you will be asked to refrain from taking on new debt during the repayment period. While this can be beneficial in preventing further financial strain, it also means that you won’t be able to access credit cards or take out loans, which can limit your purchasing power. - Impact on Emergency Situations:

In the case of an emergency, you won’t be able to rely on credit cards or other forms of credit if you’re following the guidelines of your DMP. This can put a strain on your ability to manage unexpected financial challenges, such as medical expenses or car repairs.

5. Long-Term Commitment and Financial Discipline

A Debt Management Plan requires a long-term commitment and significant discipline to stick with the program. Here are some factors to consider:

- Time Commitment:

DMPs typically last between 3 to 5 years, meaning you must remain committed to making regular monthly payments throughout that time. If your financial situation changes and you’re unable to keep up with the payments, you may have to reevaluate your participation in the plan. - Financial Discipline:

Successfully completing a DMP requires strict financial discipline. You must avoid accruing new debt, make consistent monthly payments, and follow the guidelines set forth by the credit counseling agency. If you fail to adhere to these rules, you may risk falling back into debt and potentially having to abandon the DMP. - Potential for Burnout:

For some individuals, the long repayment period can feel overwhelming. It may feel like progress is slow, and this can lead to burnout or frustration. Staying motivated for the duration of the plan can be challenging, especially if unexpected financial difficulties arise.

6. Fees Associated with the Plan

While Debt Management Plans are designed to be affordable, there are typically fees associated with setting up and maintaining the plan. These fees can vary depending on the credit counseling agency and the specifics of the plan. Common fees include:

- Setup Fees:

Some agencies charge a one-time setup fee to start your DMP. While these fees are usually modest, they are an additional cost to consider when deciding if a DMP is the right solution for you. - Monthly Service Fees:

Most credit counseling agencies charge a monthly fee to manage the plan. While these fees are usually relatively low, they can add up over time, especially if you’re enrolled in the program for several years. - Possible Additional Costs:

Depending on the complexity of your situation and the agency’s policies, there could be additional costs for things like ongoing financial education or other services offered by the credit counseling agency.

7. Lack of Flexibility in Case of Changing Financial Circumstances

A Debt Management Plan is a relatively inflexible solution. While it can help individuals in most cases, it may not be adaptable to changing financial circumstances. Some limitations include:

- Fixed Monthly Payments:

The DMP requires you to make fixed monthly payments over a set period of time. If your financial situation changes (e.g., you lose your job or have an unexpected expense), it may be difficult to adjust the plan without affecting your ability to stay on track. - Limited Room for Financial Freedom:

A DMP can be restrictive in terms of your financial freedom. Since the focus is on paying off debt, you may find it hard to save for other financial goals, such as building an emergency fund or saving for retirement.

Also Read : What Is Debt Settlement And How Can It Help You?

Conclusion

A Debt Management Plan is a powerful tool for individuals who are overwhelmed by unsecured debt and need a structured approach to regain control of their finances. By consolidating multiple debts into one affordable monthly payment, lowering interest rates, and waiving fees, a DMP can help you pay off your debt in a manageable way. While it requires discipline and a long-term commitment, a Debt Management Plan offers a path to financial freedom and improved credit in the future. If you’re struggling with debt and unsure of where to turn, a Debt Management Plan could be the solution you need to reclaim your financial stability.

FAQs

1. What debts can be included in a Debt Management Plan?

A DMP typically includes unsecured debts such as credit card debt, medical bills, and personal loans. Secured debts like mortgages and auto loans are usually not part of a DMP.

2. How much does a Debt Management Plan cost?

Fees for a Debt Management Plan vary depending on the credit counseling agency. Typically, you’ll pay a one-time setup fee and a small monthly fee for managing the plan. These fees are usually affordable and are often much lower than the interest and fees you’d pay if you continue to carry high-interest debt.

3. How long does a Debt Management Plan take to complete?

A Debt Management Plan typically takes 3 to 5 years to complete, depending on the amount of debt you owe and your ability to make monthly payments.

4. Will a Debt Management Plan help me avoid bankruptcy?

Yes, a DMP can help you avoid bankruptcy by providing a structured way to pay off your debt without resorting to more drastic measures.

5. Will creditors stop calling me if I enroll in a Debt Management Plan?

Yes, once you enroll in a DMP, your credit counseling agency will act as the intermediary with your creditors. This often stops collection calls and gives you peace of mind while you work on repaying your debt.

6. Will a Debt Management Plan affect my credit score?

Enrolling in a DMP can cause a slight dip in your credit score initially, as creditors report that you’re in a formal repayment plan. However, making consistent, on-time payments through the plan will help rebuild your credit score over time.

7. Can I cancel my Debt Management Plan?

Yes, you can cancel your DMP at any time, but it’s important to understand that canceling the plan may result in the return of higher interest rates and fees that were negotiated with your creditors.