Managing debt is one of the most important aspects of achieving financial freedom. Debt can be a powerful tool when used responsibly, but when mismanaged, it can create significant stress and hinder your ability to build wealth. The journey to mastering debt management involves understanding the different types of debt, learning how to prioritize payments, creating a plan for eliminating debt, and ultimately adopting financial habits that promote long-term success.

Key Takeaways:

Seek professional help if needed to ensure you’re on track to achieve your financial goals.

Understand your current financial situation by evaluating all debts and tracking your income and expenses.

Set clear, actionable financial goals that align with your long-term aspirations.

Choose a debt repayment strategy that suits your needs, such as the debt snowball or avalanche method.

Stick to a budget that prioritizes debt repayment while covering essential expenses.

Develop healthy financial habits, including living below your means and avoiding new debt.

Understanding Debt: The Foundation of Financial Management

Before we dive into debt management strategies, it’s crucial to understand what debt is and how it What Is Debt?

Debt refers to money that is borrowed, typically from a financial institution like a bank or a credit provider, with an agreement to repay the amount over time with interest. Debt allows individuals, businesses, and even governments to obtain immediate access to funds and repay them over a set period.

Key elements of debt include:

- Principal: The original amount borrowed.

- Interest: The cost of borrowing the money, typically expressed as an annual percentage rate (APR).

- Repayment terms: The conditions under which the debt must be repaid, including the repayment schedule, amount, and length of the loan.

In essence, debt is a financial obligation that requires repayment over time. Its effective management is crucial for maintaining financial health, and improper management can lead to long-term financial struggles.

Why Does Debt Exist?

Debt plays an essential role in the economy. It provides individuals and businesses with the necessary funds to make large purchases, invest in projects, or cover immediate expenses. For individuals, debt is often used to finance major life expenses such as purchasing a home, paying for education, or buying a car. For businesses, debt may be used to finance expansion, operational costs, or research and development.

However, it’s important to recognize that not all debt is created equal. The way debt is used, the terms of the loan, and the ability to repay it on time are what ultimately determine whether debt is a helpful financial tool or a dangerous burden.

Types of Debt

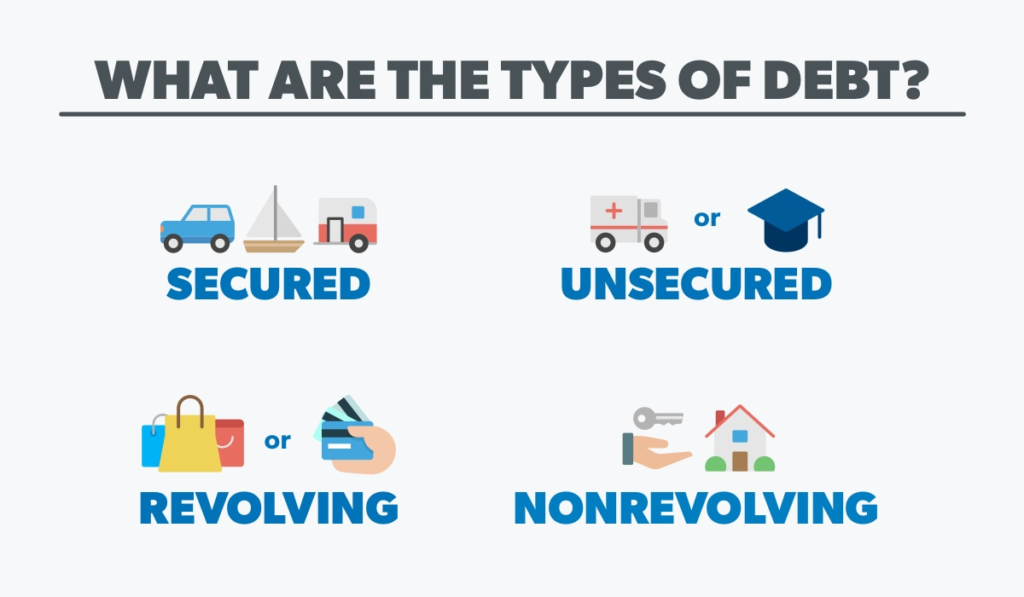

Debt comes in various forms, and understanding the differences is essential for managing it effectively. The two primary categories of debt are secured and unsecured debt.

1. Secured Debt

Secured debt is backed by collateral — an asset that the lender can claim if the borrower defaults on the loan. Since secured debt is less risky for lenders, it usually comes with lower interest rates. Common examples of secured debt include:

- Mortgage loans: The loan used to purchase a home, with the house itself acting as collateral. If the borrower fails to repay the mortgage, the lender can foreclose on the property.

- Auto loans: Loans used to finance a car purchase, with the vehicle serving as collateral.

- Home equity loans: Loans that allow homeowners to borrow against the equity in their homes. The home is the collateral.

Since the lender has collateral in secured debt agreements, the borrower typically faces less risk of higher interest rates but may risk losing the asset if they default.

2. Unsecured Debt

Unsecured debt is not tied to any specific asset. As such, it represents a higher risk for lenders and usually comes with higher interest rates compared to secured debt. Common examples of unsecured debt include:

- Credit card debt: Revolving credit lines with high-interest rates. The borrower can carry a balance from month to month, but interest will accumulate.

- Personal loans: Loans that are not secured by collateral and are typically used for consolidating debt or covering other financial needs.

- Student loans: Loans used to finance education expenses, usually with government-provided or private lending terms.

- Medical debt: Unpaid medical bills or health-related expenses that are charged to a line of credit.

Because unsecured debt carries more risk for lenders, borrowers with high amounts of unsecured debt often face higher interest rates and more pressure to make timely repayments.

3. Revolving Debt vs. Installment Debt

Within these two main categories, debt can be further classified into two broad types:

- Revolving Debt: This type of debt allows the borrower to borrow up to a certain limit and then repay it over time. As the balance decreases, more credit becomes available to borrow. Credit cards are a prime example of revolving debt.

- Installment Debt: This type of debt involves borrowing a fixed amount of money and repaying it in regular, scheduled payments (installments) over time. Mortgages, auto loans, and student loans are examples of installment debt.

How Debt Affects Your Financial Health

Debt can have both positive and negative effects on your overall financial health, depending on how it is managed. Let’s look at both sides:

Positive Effects of Debt

When used strategically, debt can help you achieve financial goals and build wealth. Some potential benefits of managing debt responsibly include:

- Building Credit: Responsible borrowing and timely payments help build a positive credit history. This can increase your credit score, making it easier to secure favorable loan terms in the future.

- Leverage for Investments: Borrowing can allow you to make investments in assets that appreciate over time, such as real estate or education. These investments can provide financial returns that exceed the cost of borrowing.

- Flexibility: Debt can provide the flexibility to make large purchases or take advantage of opportunities that would otherwise be out of reach.

Negative Effects of Debt

If not managed well, debt can lead to significant financial strain. Some potential negative effects of poor debt management include:

Debt Cycle: When debt payments are missed or deferred, borrowers often end up taking on more debt to cover existing obligations, which creates a cycle of borrowing that is difficult to escape.

High Interest Payments: With unsecured debt (like credit card debt), interest rates can be exorbitantly high. Over time, these interest payments can add up, making it harder to pay off the principal amount owed.

Financial Stress: Constantly worrying about how to make debt payments can cause mental and emotional stress. Missing payments can also damage your credit score, leading to long-term financial challenges.

Step 1: Evaluate Your Current Financial Situation

The first step in mastering debt management is to evaluate your current financial situation. This includes understanding how much debt you owe, the interest rates, and the terms of your repayment obligations. Here’s how you can do this:

- List all debts: Write down every debt you owe, including credit cards, student loans, mortgages, auto loans, and any other obligations.

- Identify interest rates and terms: Know how much interest you’re paying on each debt. This will help you prioritize which debts to pay off first.

- Assess your income and expenses: Review your monthly income and expenses. Identify areas where you can cut back or reallocate funds towards debt repayment.

- Check your credit score: Your credit score plays a significant role in determining your loan terms and interest rates. Understanding your score can help you make better financial decisions moving forward.

By thoroughly assessing your current financial situation, you can create a clear picture of where you stand and what steps need to be taken to move forward.

Step 2: Set Clear Financial Goals

To effectively manage your debt, you need to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals should align with your long-term aspirations, such as owning a home, starting a business, or retiring comfortably.

- Short-term goals: These might include paying off credit card debt, creating an emergency fund, or building a savings buffer.

- Medium-term goals: Medium-term goals could involve eliminating high-interest debt, improving your credit score, or paying off student loans.

- Long-term goals: Long-term goals include achieving financial independence, saving for retirement, or purchasing a home without relying on debt.

Setting clear financial goals provides motivation and direction in your debt management journey.

Step 3: Develop a Debt Repayment Strategy

Once you’ve assessed your financial situation and set clear goals, it’s time to create a strategy to pay off your debt. There are several debt repayment methods you can use, and each has its advantages and disadvantages.

1. The Debt Snowball Method

The debt snowball method involves paying off your smallest debt first, regardless of the interest rate. Once you pay off the smallest debt, you move on to the next smallest, and so on. This method can be motivating, as it provides quick wins along the way. However, it may not always be the most cost-effective method since it doesn’t prioritize high-interest debts.

2. The Debt Avalanche Method

The debt avalanche method involves focusing on paying off your highest-interest debt first, while making minimum payments on other debts. Once the highest-interest debt is paid off, you move on to the next highest, and so on. This method is financially efficient since it minimizes the total amount of interest you pay over time.

3. Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your payments and reduce the overall cost of borrowing. However, debt consolidation should be approached with caution, as it may not be effective unless you stop accumulating additional debt.

4. Debt Settlement

Debt settlement involves negotiating with creditors to reduce the total amount owed. While this can help you reduce your debt, it can negatively affect your credit score and is typically only a viable option for those facing significant financial hardship.

Choose the strategy that best aligns with your financial goals, and remember, consistency is key to success.

Step 4: Create a Budget and Stick to It

A well-organized budget is essential for effective debt management. A budget helps you track your income and expenses, ensuring that you’re allocating enough funds toward debt repayment while covering your essential living costs.

To create a budget:

- Track your income: Include all sources of income, including salary, freelance work, or side hustles.

- List your expenses: Categorize your expenses (e.g., housing, utilities, groceries, transportation) and identify areas where you can reduce spending.

- Allocate funds for debt repayment: After covering your essential expenses, set aside as much money as possible for debt repayment. Prioritize high-interest debts to minimize the overall amount paid in interest.

The more disciplined you are with your budget, the faster you’ll be able to eliminate debt and achieve financial freedom.

Step 5: Adopt Healthy Financial Habits

Mastering debt management isn’t just about paying off debt — it’s about adopting a mindset that fosters long-term financial health. Here are a few habits to incorporate into your daily life:

- Live below your means: Avoid lifestyle inflation by keeping your expenses in check as your income grows. Prioritize saving and investing for the future.

- Build an emergency fund: An emergency fund is essential for preventing further debt accumulation in the event of unexpected expenses.

- Avoid taking on new debt: Resist the temptation to open new credit cards or take on loans while you’re working on paying down existing debt.

- Review your financial progress: Regularly review your budget and debt repayment progress. Adjust your plan if necessary to stay on track.

With these habits in place, you’ll be better equipped to achieve and maintain financial freedom.

Step 6: Seek Professional Help if Needed

If you find yourself overwhelmed by debt or struggling to make progress, consider seeking help from a financial advisor or credit counselor. A professional can offer personalized guidance, help you create a debt management plan, and explore options such as debt consolidation or settlement.

The Role of Interest Rates in Debt Management

Interest rates play a central role in determining how much you will end up paying for borrowed money. The higher the interest rate, the more expensive the debt becomes. Over time, compound interest can cause the amount owed to grow exponentially, making it more difficult to pay off.

- Fixed interest rates: These stay the same throughout the life of the loan, providing stability in monthly payments.

- Variable interest rates: These can fluctuate over time, meaning that your monthly payments could increase or decrease depending on changes in the market.

Conclusion

Mastering debt management is not an overnight process, but with the right strategies and mindset, it’s absolutely achievable. By understanding the different types of debt, setting clear goals, choosing the right repayment plan, sticking to a budget, and cultivating healthy financial habits, you can reduce your debt and ultimately achieve financial freedom. Stay disciplined, be patient, and take one step at a time — financial freedom is within your reach.

FAQs

1. How do I prioritize which debt to pay off first?

If you’re following the debt avalanche method, prioritize the highest-interest debt first. If you’re using the debt snowball method, focus on paying off the smallest balance first for a quick win.

2. Should I pay off debt or save money?

While both are important, paying off high-interest debt should be prioritized over saving until you have an emergency fund established.

3. Can debt consolidation hurt my credit score?

Debt consolidation can initially cause a slight dip in your credit score, but over time, it can help you improve your score by reducing overall debt and making payments more manageable.

4. How long does it take to become debt-free?

The length of time it takes to become debt-free depends on the amount of debt you owe, your income, and how aggressively you tackle your repayment strategy.

5. Can I negotiate my debt with creditors?

Yes, in some cases, creditors may be willing to negotiate lower interest rates, reduced payments, or even a settlement amount to help you manage your debt.

6. What happens if I can’t make my debt payments?

If you miss payments, your credit score will likely suffer, and creditors may pursue collection actions. In extreme cases, bankruptcy could be an option, but it’s important to consult with a financial professional first.

7. How can I rebuild my credit after paying off debt?

After paying off debt, focus on making on-time payments, reducing credit card balances, and monitoring your credit report regularly to rebuild your credit score.